What is Gift Aid?

Gift aid allows charities and CASC (community amateur sports clubs) to claim an additional 25p for every £1 donated.How can I check if I can claim Gift Aid?

To find out if you are able to claim gift aid please head to page https://www.gov.uk/claim-gift-aid where you can see all official information about gift aid and who can apply.What information do I need to collect for Gift Aid?

You will need to have to collect the following from your customer

- The donor’s full name

- The donor’s home address (at least their house number or name and postcode)

You will also need confirmation the following:

- The donor has paid the same amount or more in Income Tax or Capital Gains Tax in that tax year.

- The donor agrees to Gift Aid being claimed

How do we create this on RapidReg?

All of these requirements can be created in the form builder, if you are setting up a form with the donations pre-set it will be set by default. If not these are the settings you will need:

-

Donors Name: This will be automatically collected on every form but you may wish to personalise it.

Textfield Short Text.

Title: Full name or x 2 for First and Last name. -

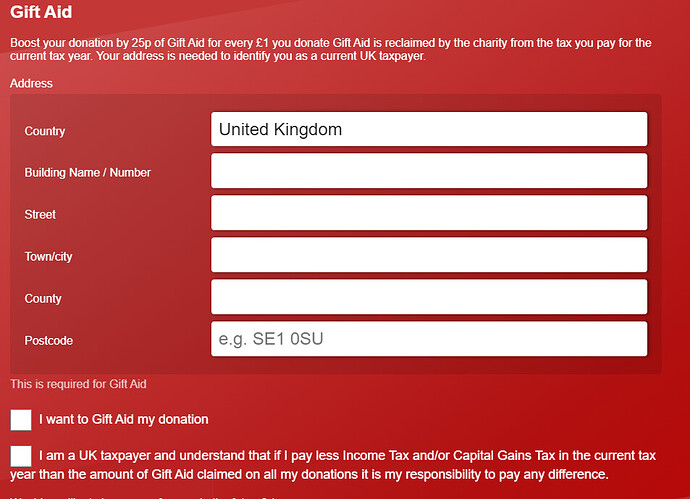

Inline text

Title: Gift Aid.

Body text: Boost your donation by 25p of Gift Aid for every £1 you donate -

Donors Address

Address field

Title: Address -

Check box Single

Title: I want to Gift Aid my Donation -

Check Box single

Title Gift Aid is reclaimed by the charity from the tax you pay for the current tax year. Your address is needed to identify you as a current UK taxpay

How do I export my data for gift aid?

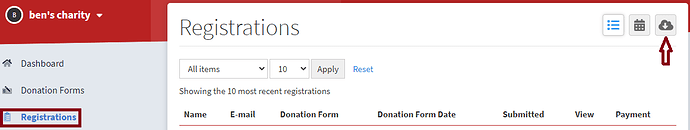

When you need to export your data, you will need to head to registrations and export

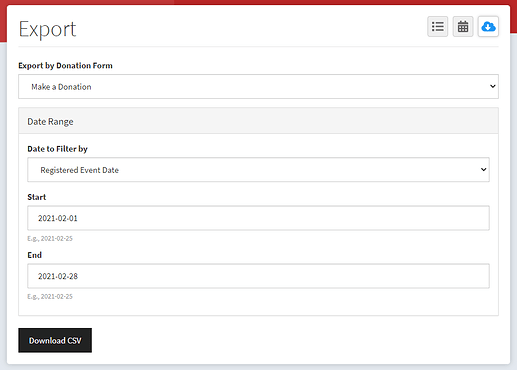

Here you can choose your filters before exporting to CSV. file.

Alternatively you can check out our Zapier connection and have it update your software automatically: